National Bonds (Free Android App) Login/ Winners/ UAE / Contact Number/ Corporation/ Calculator/ Download Latest Version

| App | National Bonds |

|---|---|

| Publisher | Pearl Mod Apk |

| Genre | Business |

| Price | Free |

| Version | 2.9.19 |

| Size | 94 MB |

| Mod Info | UAE / Calculator / Contact Number / Login / Winners / Corporation |

| Original | |

| Latest Update | {a few hours ago} |

| Offered By | National Bonds Corporation PJSC. |

Introduction

National Bonds UAE has emerged as an important financial instrument, providing a specific avenue for people to encourage financial growth and protection. In times of financial weakness, these securities have gained a reputation for their function in advancing reserve funds, venture capital, and long-range financing.

Bonds refer to a type of government venture item that empowers people to allocate cash while earning serious returns. These securities are usually issued by the public authority to support various start-up activities and campaigns. Financiers buy these securities, essentially lending cash to the National authority, and as a result, they receive periodic premium installments along with the underlying venture capital on growth.

The Significance of Bonds:

Empowerment of Savings:

UAE National Bonds play an important role in empowering the culture of reserve funds among the people. By putting resources into these bonds, individuals are encouraged to save a portion of their salary for the future, creating financial flexibility and a safety net during unforeseen circumstances.

Supporting National Development:

States use the assets raised through Bonds for infrastructure projects, training campaigns, upgrading of medical services, and other public development programs. This leads to general financial growth and cultural development.

Stability and Security:

Bonds are considered a safe venture choice for the most part. Because they are granted by the legislature, default is less likely than other venture choices. This degree of protection is particularly attractive to risk-averse financial contributors.

Advantages of Investing in Bonds

Steady Income Stream:

Financial helpers receive periodic interest installments through bond accommodation, providing a solid source of automatic income.

Extension:

Bonds offer a significant extension to an individual’s speculative portfolio, increasing risk and reducing exposure to unpredictability.

Long-Term Financial Planning:

These bonds are a fantastic tool for those trying to anticipate long-range goals, for example, retirement, education expenses, or buying a home.

Accessible to All:

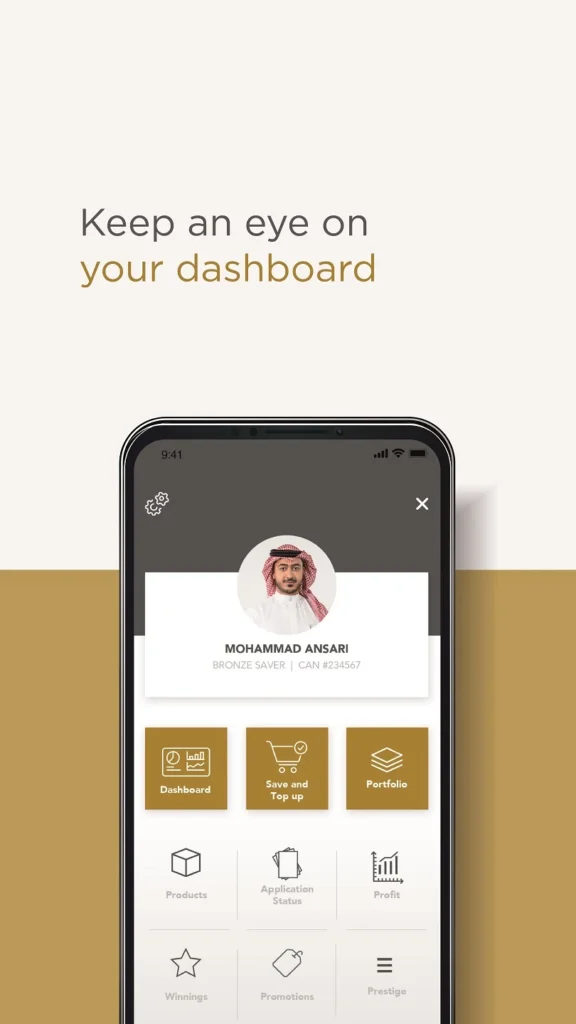

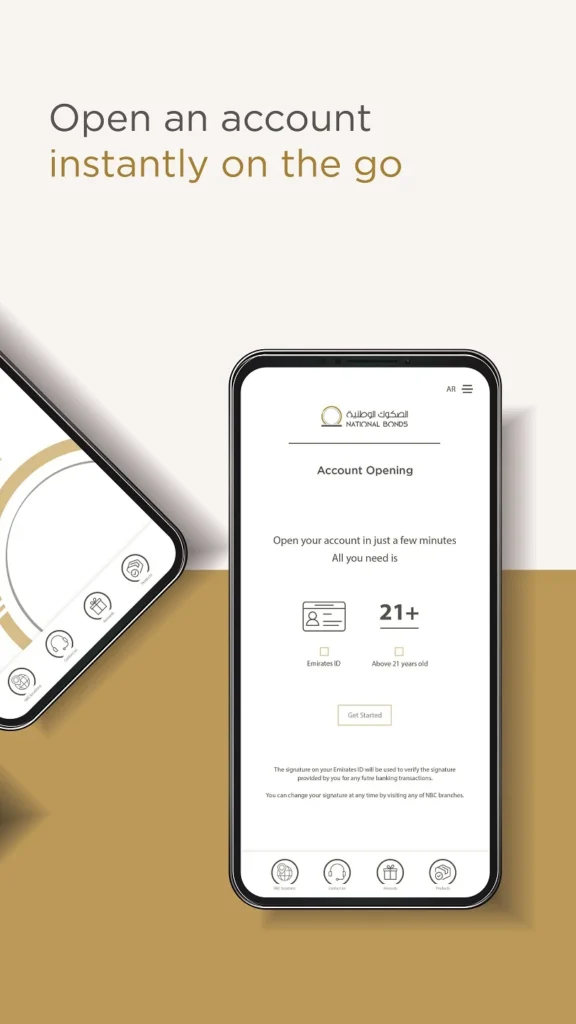

National Bonds Login are often intended to be open to many financiers, regardless of their financial base. This inclusion guarantees that a large section of the population can benefit from the expected profits.

Contribution To National Economies

The effect of Bonds extends past individual financial backers. They mainly contribute to National economies by:

Subsidy Framework:

Capital raised through Bonds helps build and maintain infrastructure, promoting a financial turn of events.

Reducing Debt Burden:

States can use the assets raised through bonds to reduce dependence on external liabilities, thereby working on fiscal well-being and security.

Jobs creation:

Projects supported by National Bonds Corporation often create incredible openings for business, help further financial mobility and lower unemployment rates.

FAQs

How do I buy national savings bonds?

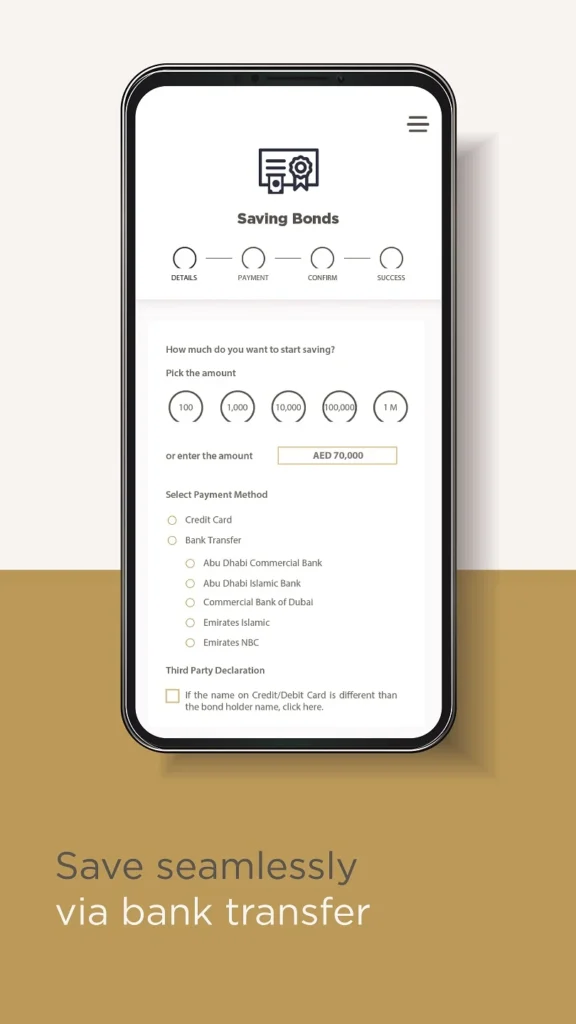

Simply complete an application form and send it to us with a look at NS&I Payable. In case you or your child already have some premium bonds, you can buy through bank transfer (counting permanent application).

What is the interest rate of National Bond in UAE?

This National Bond gives the exceptional benefit of early dividends for a continuous period of four years. The annualized rate of return is 3%, making it 12% over four years. The principal interest on the bond is AED 10,000.

Is National bond in UAE safe?

Generally, safe speculation in the way that Bonds are administration security makes it a fine venture. You secure the installment as the credit risk is negligible. The goal of the Bonds is to empower reserve funds and offer returns on them.

Conclusion

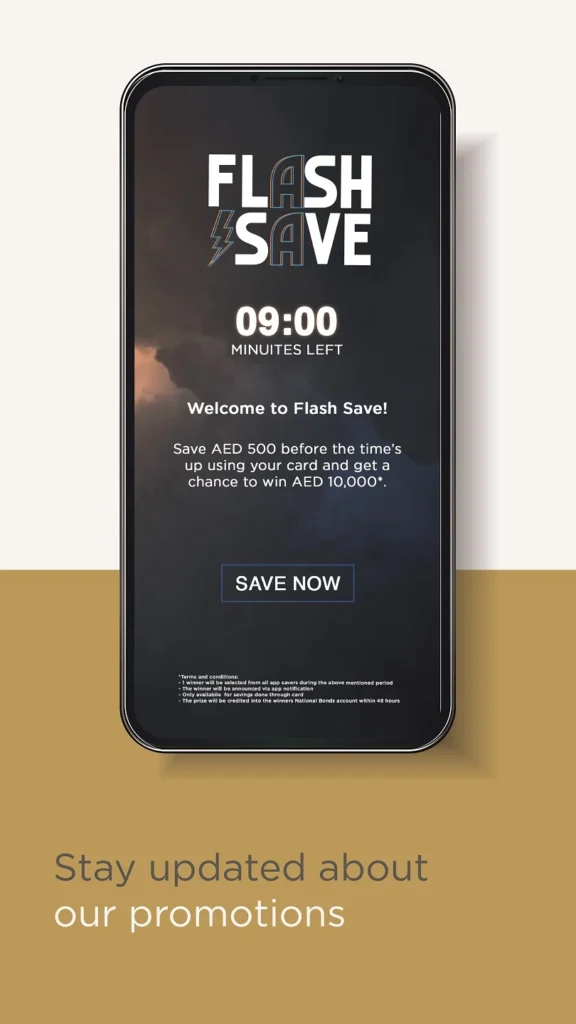

National Bonds bridge the gap between individual financial desires and public betterment goals. These securities offer tangible and rewarding implications for people to save, contribute and plan for the future, while at the same time enhancing the development of their countries. As states continue to focus on fiscal growth and stability, National Bonds (Winners) will likely continue to be an obscure and powerful tool in accomplishing these goals. Whether for individual financiers or for society as a whole, Bonds serve as a guide to financial strength and success.

National Bonds v2.9.19 (Free Android App) - PEARLMODAPK

National Bonds is a progressive financial instrument encouraging solidarity and sound savings in the United Arab Emirates, offering open doors to inclusive speculation and locally driven drives.

Price: 0.00

Price Currency: USD

Operating System: Android

Application Category: Business

4.3